Vehicle purchase with an online financing solution

Details

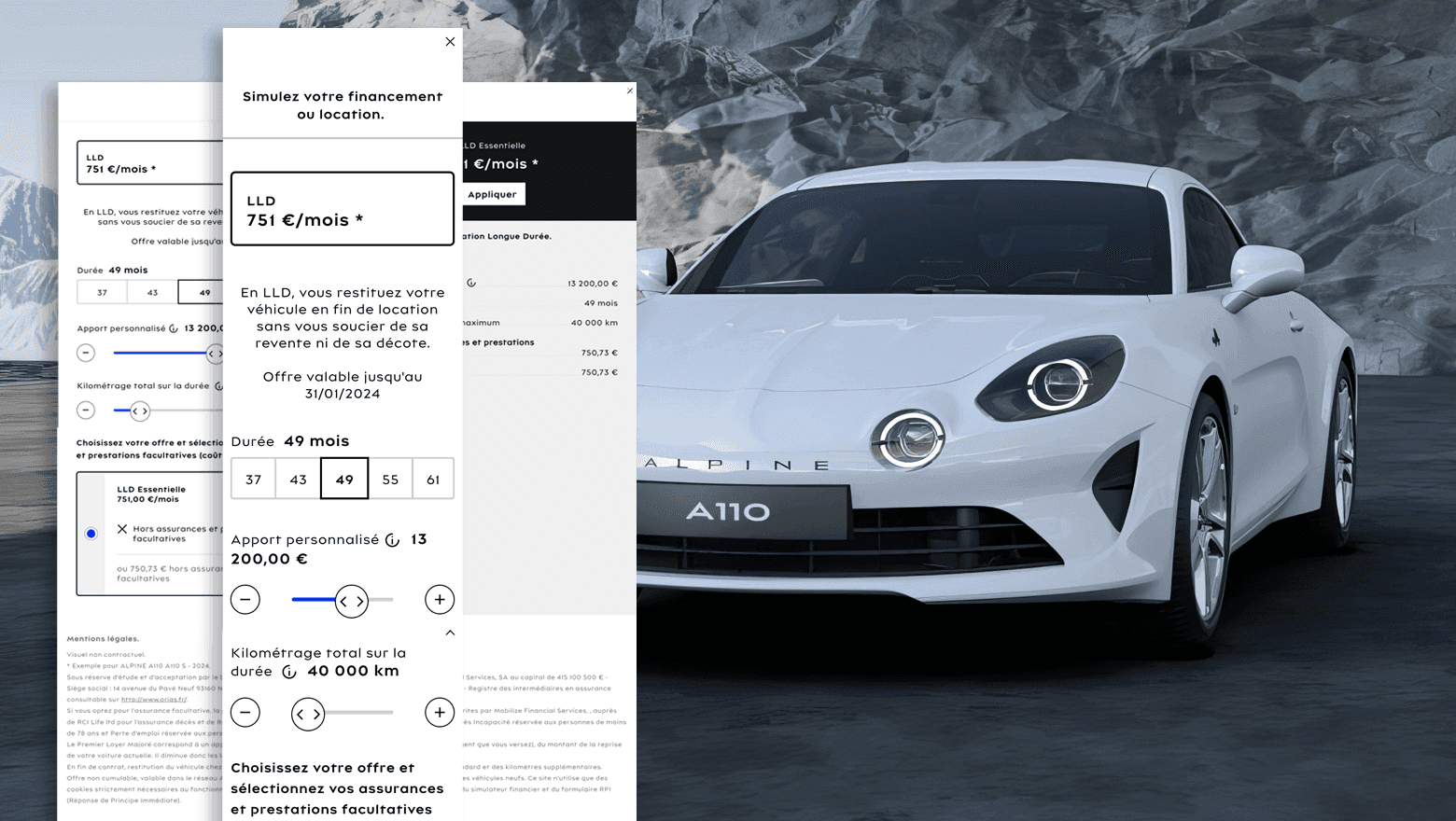

One of the most crucial factors influencing the client’s decision to purchase a car is the cost of the monthly payments. The Renault Group brands and the Nissan Group brands, in cooperation with Mobilize Financial Services, commercial brand of RCI Banque S.A., wished to provide a solution which would enable their clients to calculate the number of their monthly payments directly on the website, on the basis of parameters updated in real-time. By being able to calculate the estimated amount of an instalment, clients could make a simulation of a projected level of expenses prior to visiting a dealership. This is why MFS decided to make their powerful calculating engine available on-line and partnered with MakoLab to make it happen.

• the default setting (i.e. ‘Default Offer’) - information about the monthly instalment of a standard credit or leasing offer is provided automatically

• interactive simulation with the possibility to adjust parameters (such as e.g. down payment or additional insurances).

The financial simulators, developed by MakoLab, are fully adjustable to a specific brand’s corporate identity and the front-end solution can be easily integrated on any website, including car configurator. It enables the potential client to instantly evaluate their crediting options in detail, right after configuring a selected car offered by Renault-Nissan. In selected countries pre-approval functionality enables the customers to obtain reliable information about whether they will be granted financing without the need to contact the financial institution.

Additionally, the simulators can be augmented with the possibility to send questions directly to a specified dealer or an Mobilize Financial Services representative. The simulators are often updated visually to respond to the dynamically changing visual appearance of the websites and for their constant optimization in regards to their usability. Security and operational performance are ensured by the server infrastructure located in MakoLab’s Data Center. The cluster architecture with load balancing allows for continuous operation, even in the case of a failure of one of the processing servers. What is more, to protect our clients better, we have implemented GCP cloud-based DRP which we can run in the event of server outages and during planned maintenance windows to ensure service continuity. The choice of the cloud solution was the result of a careful planning process together with the client.

MFS’s calculating engines and MakoLab’s financial simulator together respond to over 8M operations daily. The solution supports 4 world-leading automotive brands across 21 countries. Our front-end simulators are used not only across OEM’s national websites but also on 1k+ dealer pages The success key is the close cooperation between the MFS’s and MakoLab’s teams, fast and precise data exchange between the MFS calculating engines and MakoLab’s financial simulators, and the ability on both sides to quickly adapt to customers’ evolving needs, legal requirements, and optimisation requests. Thanks to this flawless and active work, we will be soon celebrating 16 years of successful collaboration.