Take your online car financing to the next level

Details

Toyota Financial Services (TFS) is the Toyota Motor Corporation’s captive bank. Operating in more than 30 countries and regions around the world, its focus is on auto loans and leases for Toyota brand dealerships. TFS provides financing to approximately 12.2 million customers annually.

A major challenge presented by the project was to ensure the smooth integration of Toyota Motor accessories and services with TFS financial products, while providing a user-friendly experience. Integrating the car configuration process and financing quotes was essential, which meant that a range of systems and databases had to be connected.

At the same time, the client expected the solution to combine the company’s ethos and its market-specific requirements.

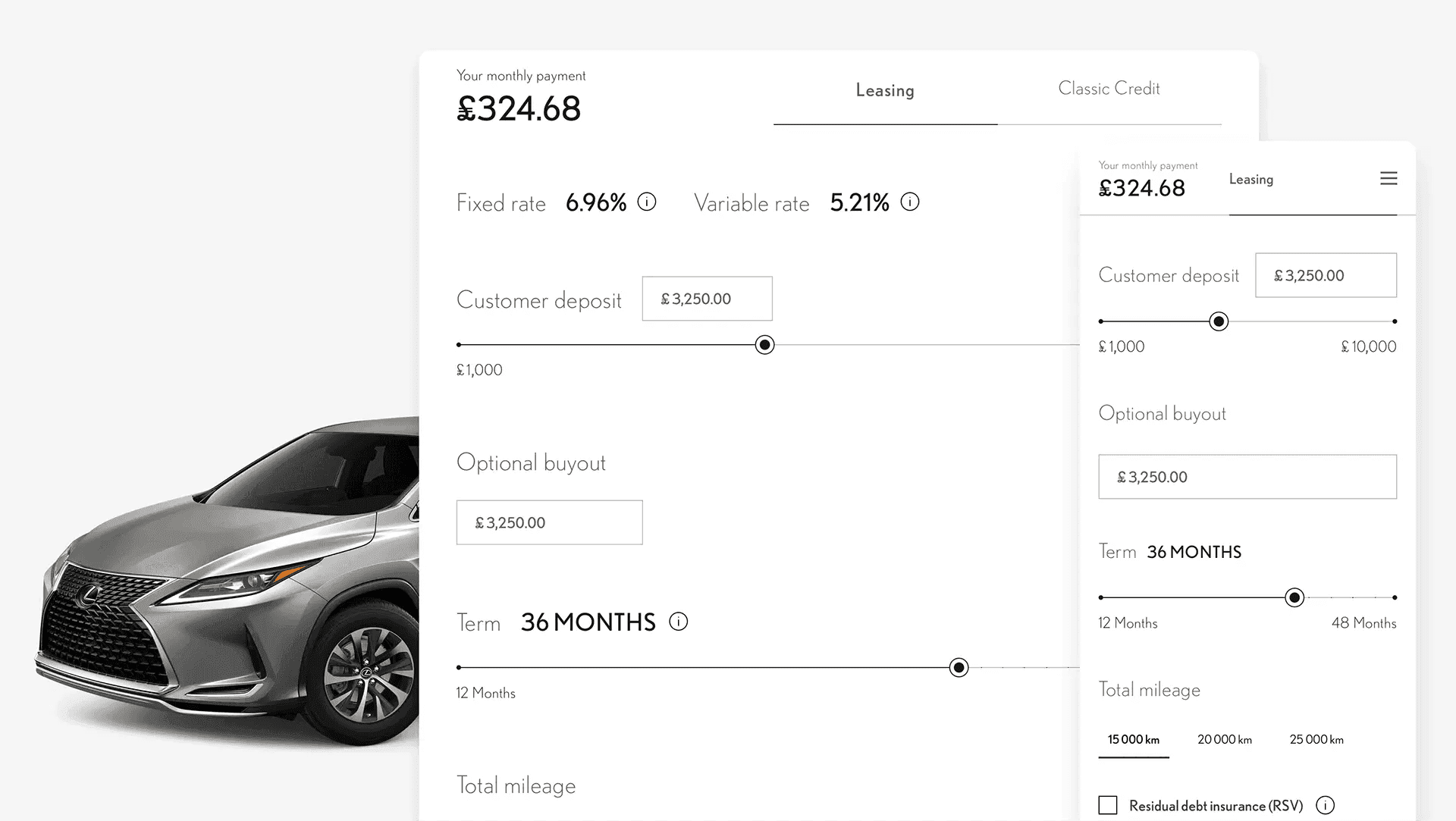

The goal was to make online car purchasing available to Toyota customers by integrating the online car configuration experience with fully visible and adjustable financing quotes. Every customer should be provided with the opportunity of understanding and putting their car financing offer together in line with their requirements and without needing to contact a bank salesperson directly.

MakoLab created and developed a comprehensive online car financing application which fully integrates every car with Toyota Motor’s range of accessories and services and with the financial products delivered by TFS.

It also makes it possible to provide real-time default offers on any web page, giving the visitor the relevant information about monthly payments. In addition, the customer can make their adjustments to the financing parameters, in line with their requirements, by using the finance calculator built in to the application. They can also check their creditworthiness and compare financing products. Finally, they can use the financial model they have set up and buy a car.

Every car financing configuration can be changed through the back office option of the application. With one click, TFS can amend interest rates, the potential duration of loans and the products available, as well as adding promotions and other parameters for the entire market.

Security and operational performance are ensured by the server infrastructure located in MakoLab’s Data Center. The cluster architecture with load balancing allows for continuous operation, even in the case of a failure of one of the processing servers. What is more, to protect our clients better, we have implemented AWS cloud-based DRP which we can run in the event of server outages and during planned maintenance windows to ensure service continuity. The choice of the cloud solution was the result of a careful planning process together with the client.

● 19 European markets where Toyota has implemented MakoLab’s online car financing tools. The region’s largest automotive sales markets, including France, Germany, Spain and the UK number amongst them, as does Poland

● Implementation is available for the Toyota and Lexus brands for New Cars and for any brand in the Toyota Used Cars Programme

● More than 1,200,000 default offer activations daily

● 10,000 finance parameter adjustments activated every day