Handling vehicle damage claims

A smart analytic system for handling transport damage claims and detecting anomalies. The system is based on machine learning techniques.

Summary

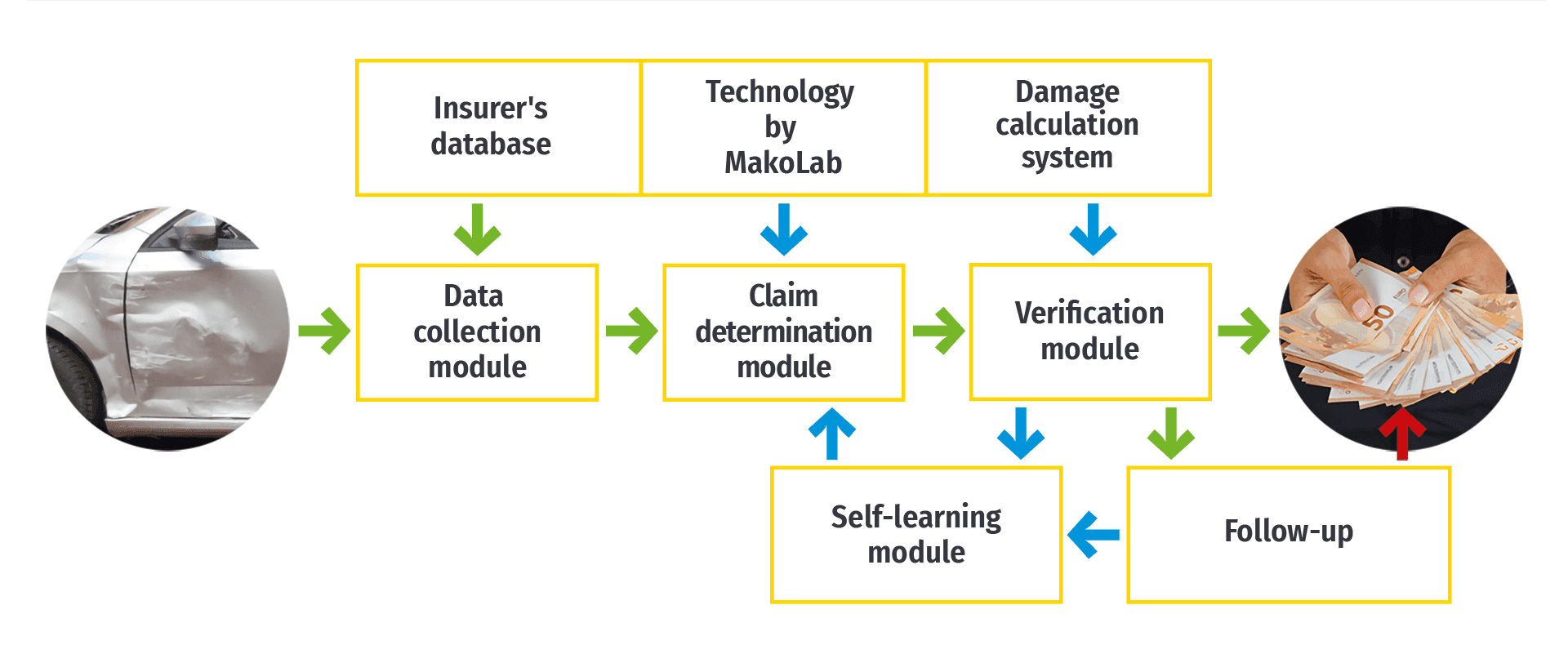

We designed a new solution which employs machine learning technology and utilises the available data more effectively. The result is a system which not only automates the analysis and settlement of claims, but also supports vehicle insurers in detecting anomalies at the documentation stage.

Client

Industry

Finance & Insurance

Service

Proof of Concept (PoC) delivery

Deliverables

Analytics system

A smart analytic system for handling transport damage claims and detecting anomalies. The system is based on machine learning techniques.

Details

Who is the system designed for?

- Financial institutions

- Insurance companies

- Experts and claims handlers

The goal

We set out to create a smart tool to support financial institutions, insurance companies, experts and claims handlers in optimising the processes of detecting and analysing damages and exposing potential fraud. Utilising machine learning techniques and putting the available data to more effective use, the system automatically verifies claims and suggests the most suitable resolution to the problem.

Claims handling

A rapid initial assessment is carried out on the basis of photographs, simplifying the process of deciding whether the vehicle should be repaired or written off. Each step is supported by cutting-edge smart technology:

- OCR technology ‘reads’ the photographs and text;

- the parts of the vehicle’s body are detected, along with the type of damage;

- the self-learning mechanisms estimate the scale of the losses or damages;

- users are automatically registered;

- data searches concerning companies’ products and services are conducted;

- damages to vehicles are assessed on the basis of historical data and up-to-date information from the market, without a physical inspection.

Searching for anomalies and detecting fraud

Using data from the insurer and information collected about specific damages, the system makes it possible to determine whether a given case reveals characteristics of attempted complete or partial fraud. The efficacy rate is over 80%. The system:

- analyses several dozen features of various kinds in every case of damages;

- builds databases for analyses carried out on the basis of specific accidents;

- implements an ontology in order to analyse data which can be understood by artificial intelligence algorithms.

Benefits

- Automating key parts of the claims handling process ensures a stable solution which is available 24/7 and reduces service costs

- The process can be tailored to specific handling requirements resulting from your company’s development policy and regional strategies

- Better use is made of the data and information available. This leads to:

- faster, more precise feedback, shorter claim handling times and a more transparent process, all factors which improve the customer experience;

- support for claims handlers in assessing claims for damages on the basis of the high-quality data held by your organisation;

- clear handling data in terms of estimating repair costs, making it easier to take better decisions as to where and how repairs should be carried out or whether a vehicle should be written off

Technology

We use an ontology, making it possible to:

- standardise data from various sources, facilitating the algorithms’ semantic comprehension of that data. This means, for instance, that the algorithms will understand ‘door, right, front’, ‘door, right-hand, front’ ‘right door, front’, ‘right-hand door, front’, ‘door, front right’, ‘door, front, right-hand’ ‘front right door’ and ‘front right-hand door’ as one and the same term;

- determine the division and dependencies between parts of the vehicle. As a result, the system will independently detect inaccuracies or potential fraud in a description of parts and damages;

- internationalise the software and terminology used. For example, the Polish prawe drzwi przednie and Finnish oikea etuovi are the same concept as ‘front right-hand door’ and its equivalents.